How to Buy Dogecoin with eToro in 2024 – Beginner’s Guide

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.

Alongside 90 other cryptocurrencies, regulated broker eToro enables investors to buy Dogecoin with low fees. Fiat money deposits – including debit/credit cards and e-wallets, are fee-free when payments are made in US dollars.

In this guide, we explain how to buy Dogecoin with eToro in just five minutes.

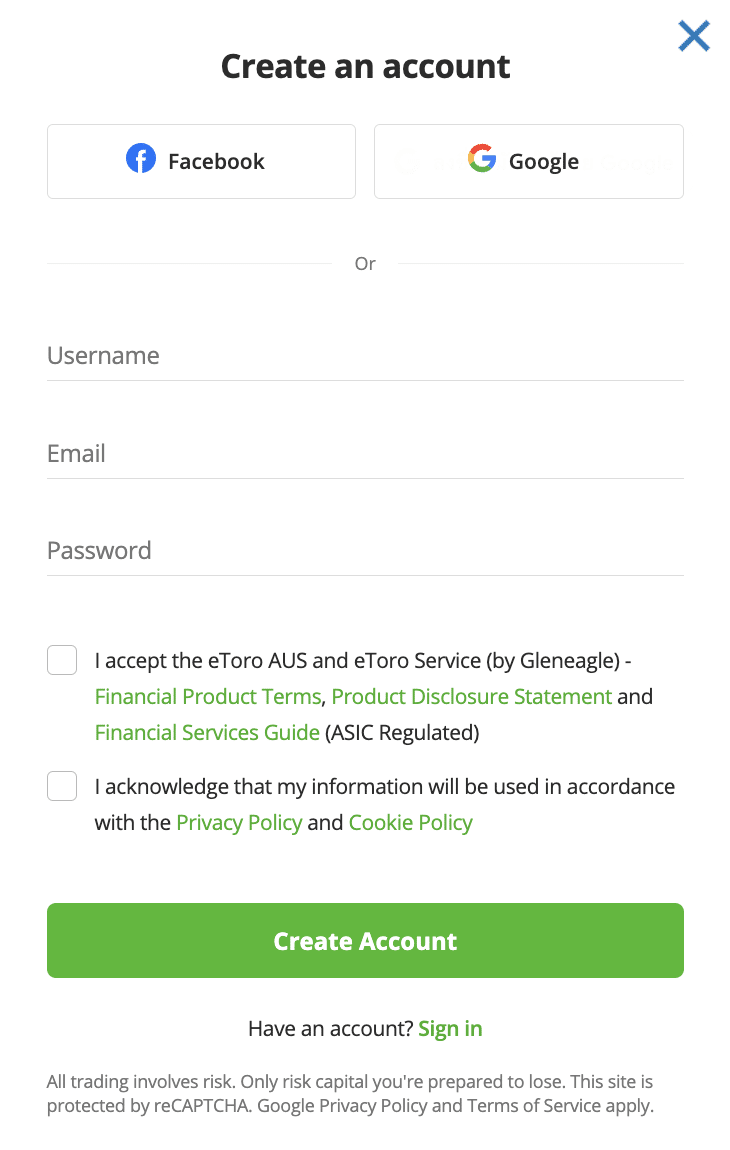

Here’s a quick walkthrough on how to buy Dogecoin with eToro in 2024: Now let’s go through a more detailed step-by-step process of how to buy Dogecoin with eToro. Like all regulated brokers, the first step is to register an account. This rarely takes more than a few minutes. Click ‘Sign Up’ on the eToro website and fill out the registration form. This initially requires a username, password, and email address. New users can also register by linking their Google or Facebook accounts. After clicking ‘Create Account’, eToro will then ask for the following information: eToro also requires new users to confirm their email and cell phone number.

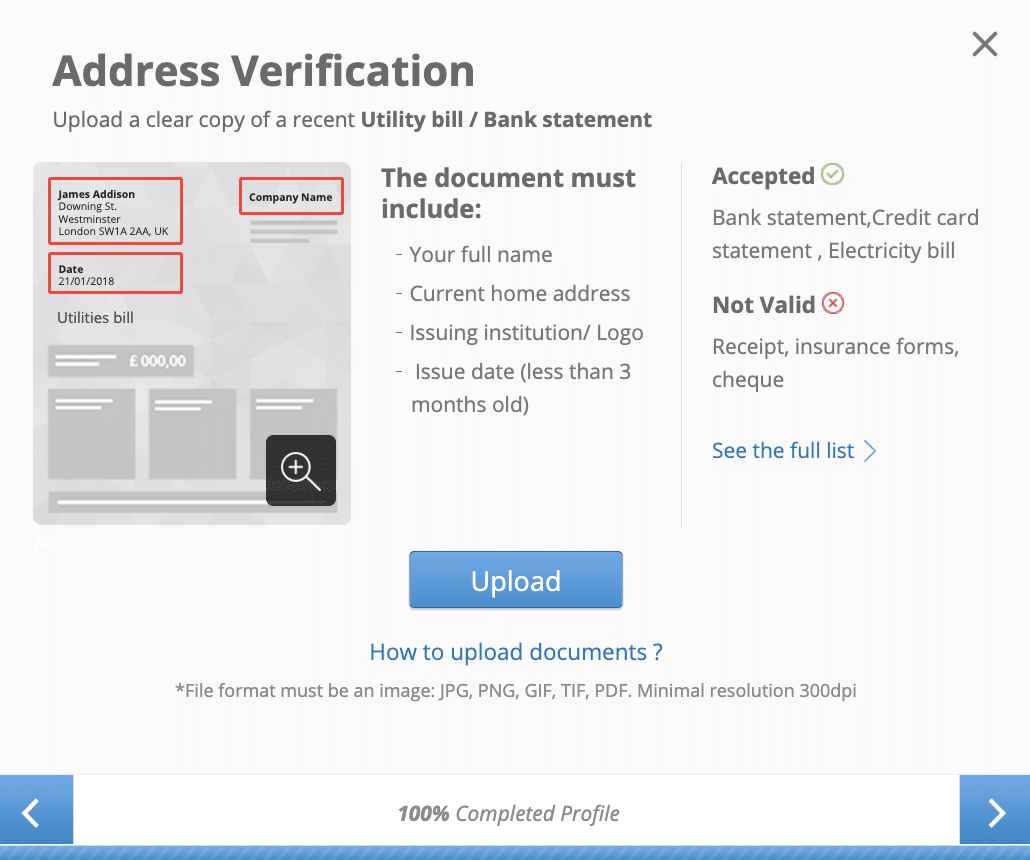

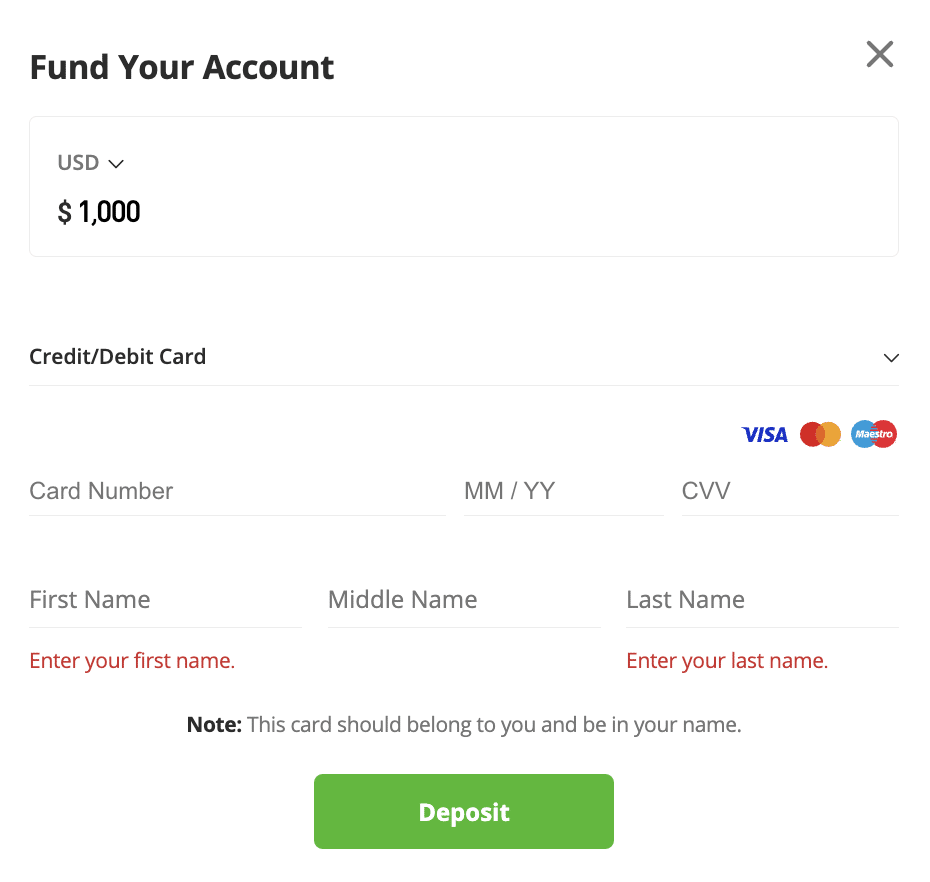

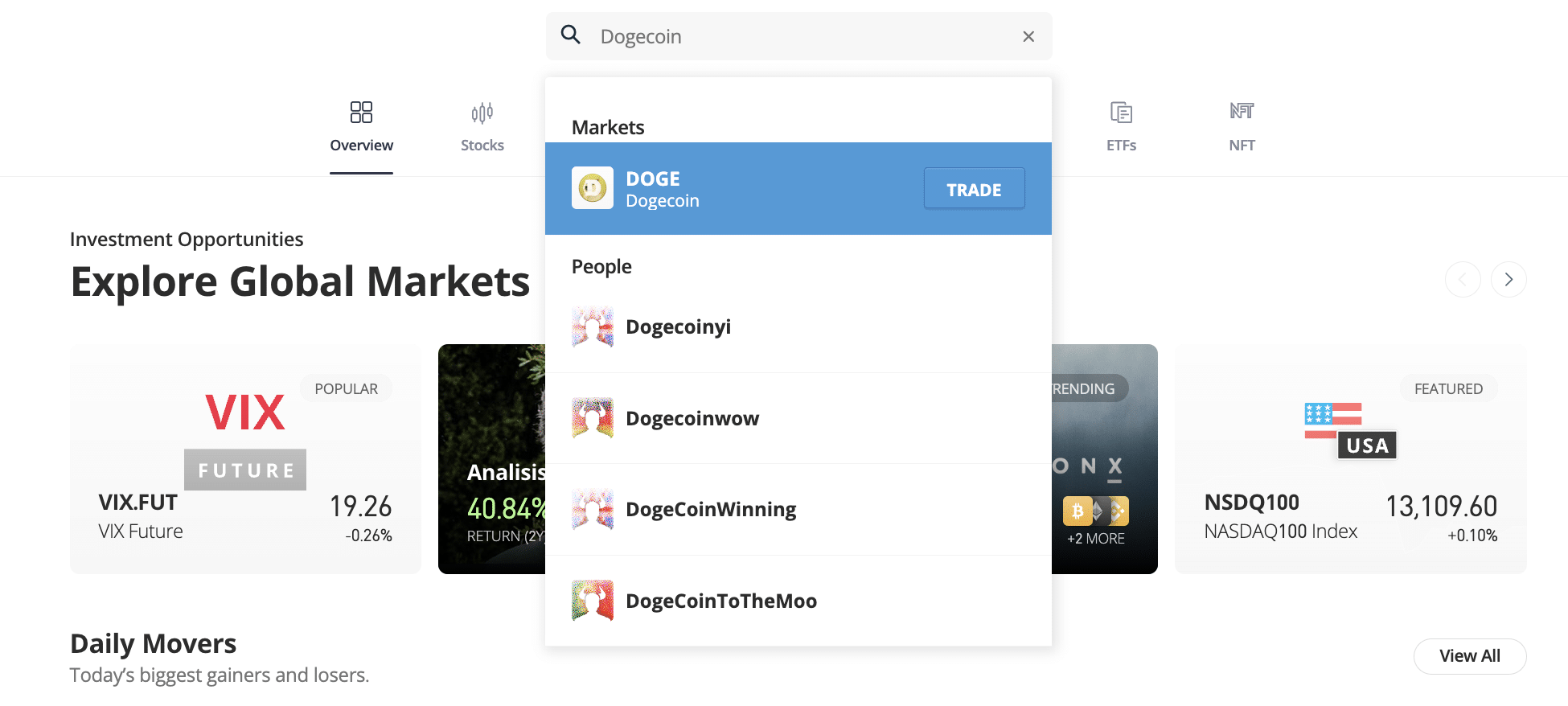

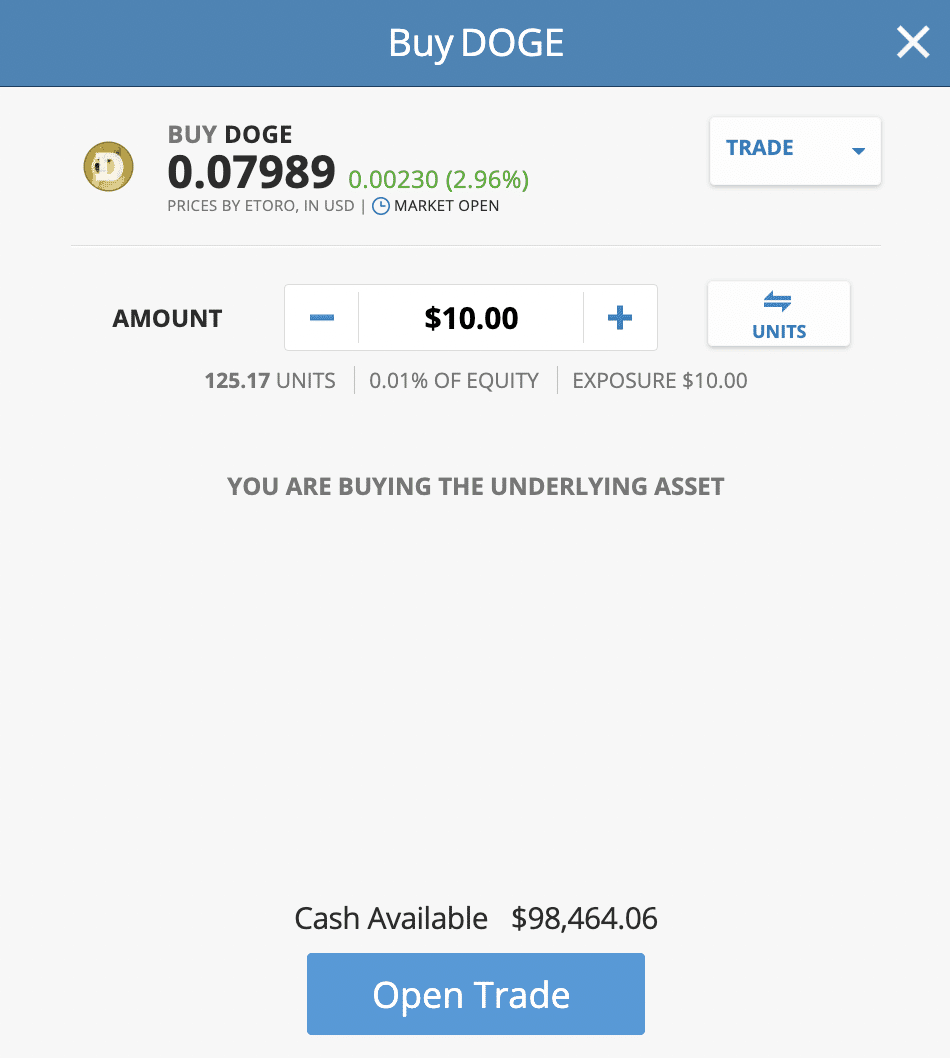

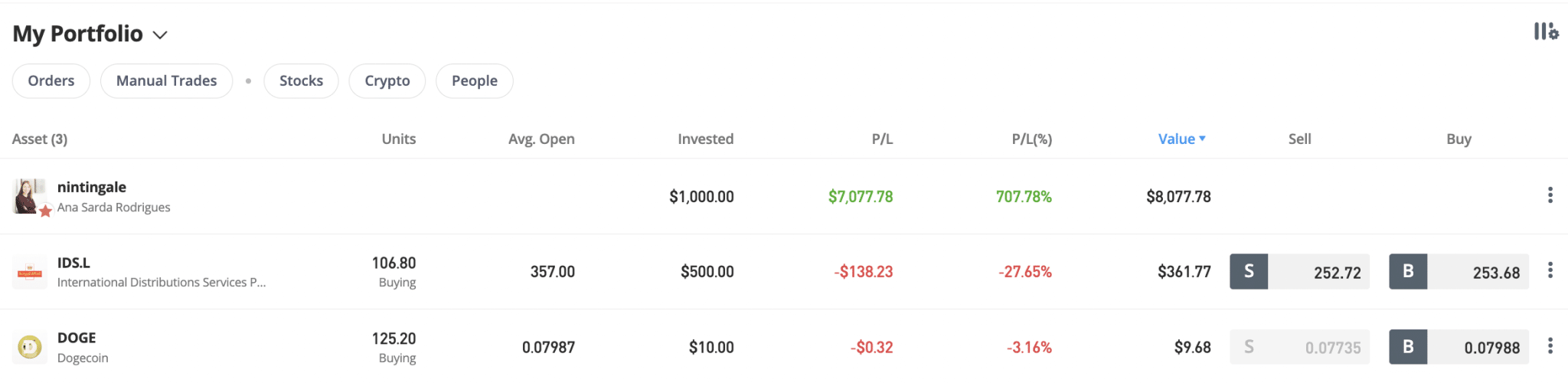

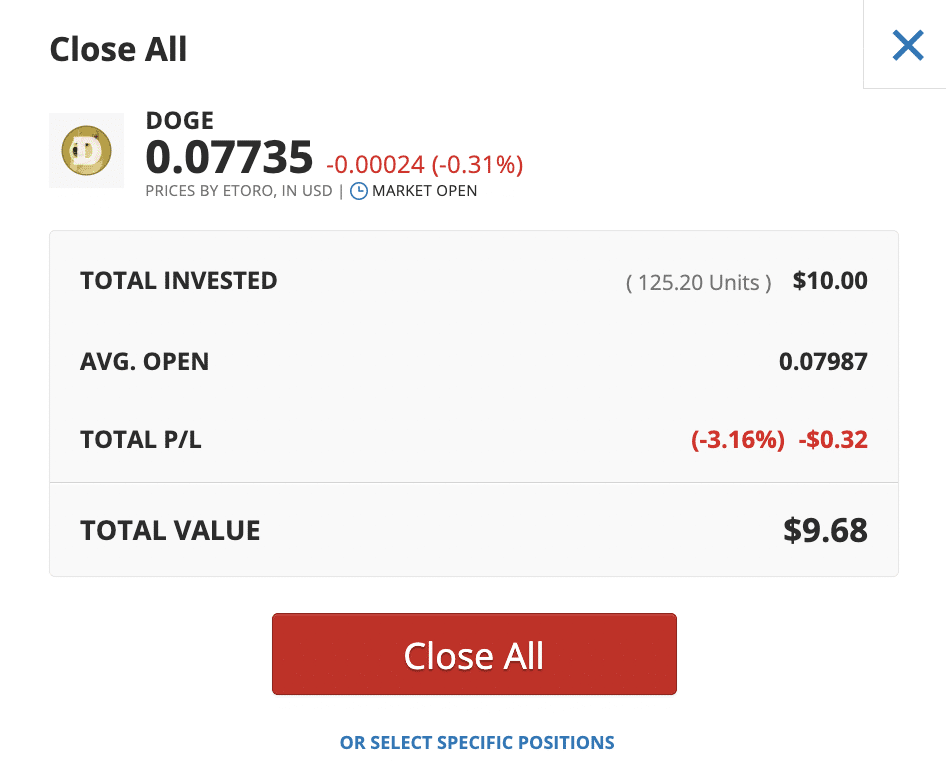

Crypto assets are a highly volatile unregulated investment product. No UK or EU investor protection. eToro is regulated by the FCA, FINRA, CySEC, and ASIC – so a KYC process is also required. First, upload a government-issued ID. Most users opt for a passport or driver’s license. Other documents are supported too, depending on the user’s country of residence. Next, upload a proof of address document issued within the past three months. Utility bills, bank statements, and other documents are accepted. In most cases, the uploaded documents will be verified in under 60 seconds. Now it’s time to deposit some funds into the eToro account. The minimum deposit is $10 for US/UK users. This increases to $50 for most other nationalities. Most eToro users deposit funds with a debit/credit card or an e-wallet, such as Paypal or Neteller. This is because the deposit will be processed instantly. That said, bank wires and local payment methods are also supported, depending on the country of residence. There are no deposit fees when the payment is made in US dollars. Those looking to deposit funds with pounds, euros, or any other supported currency will pay an FX fee of 0.5%. This is still super-competitive, especially when compared to the industry average. The easiest way to find Dogecoin on eToro is to use the search box. After all, eToro lists thousands of markets, from crypto and forex to ETFs and stocks. Search for ‘Dogecoin’ and click on the ‘Trade’ button to proceed. Just like the image below, an order box will now appear on the user’s screen. The user will need to type in the amount of money they wish to invest in Dogecoin. The minimum order size is $10. Finally, to buy Dogecoin with eToro instantly – click on the ‘Open Trade’ button. Now that the Dogecoin purchase has been made, the DOGE tokens can be found in the eToro portfolio. This is where users can check the value of their Dogecoin investment at any time. The eToro Dogecoin wallet is custodial. In simple terms, custodial wallets do not require users to secure their private keys. Instead, eToro takes full responsibility for the digital funds. Not only is eToro regulated but it utilizes cold storage wallets. This means that the DOGE tokens are never connected to servers, removing the threat of a remote hack. That said, the eToro web wallet does not come with any functionality. Those looking to transfer the DOGE tokens to another wallet or exchange will need to download the eToro Crypto money app. This is also a custodial wallet, but it comes with plenty of features. This includes an on-chain address, allowing users to send and receive DOGE tokens with ease. Plus, the eToro Crypto money app makes it simple to buy and sell Dogecoin on the move. The app is available on both iOS and Android devices. Not only is it simple to buy Dogecoin with eToro but also cash out. This is the case 24 hours per day, 7 days per week. When a suitable exit price has been achieved, log into the eToro account and click on ‘Portfolio’. Then, click on ‘Dogecoin’. There are two options when selling Dogecoin on eToro: In our example, we are looking to sell all of our DOGE tokens back to cash, so we click on ‘Close All’. Finally, eToro enables users to sell Dogecoin at the current market rate and at a specified price. We are looking to sell Dogecoin instantly, so we opt for the former. Finally, after we click on ‘Close All’ again, eToro will sell the position. The proceeds from the sale are then added to the eToro account balance. Users can then reinvest the funds into other assets or make a withdrawal. eToro is in the business of making money, so it charges fees when buying and selling Dogecoin. We examined eToro Dogecoin trading fees and have summarized our findings below: Looking to buy Dogecoin with eToro and make the payment in US dollars? If so, there are no deposit fees whatsoever. This is the case with all supported payment methods, from bank wires and debit/credit cards to e-wallets like Paypal. This is a huge deal for US clients. After all, popular US exchanges like Coinbase and Gemini charge between 3-4% on debit/credit card payments. In terms of withdrawals, US dollar payments are also fee-free. Those looking to deposit another currency into eToro, such as pounds or euros – will pay an FX fee of 0.5%. This is to exchange the currency for US dollars at the time of the payment. This is still a great deal when compared to other crypto exchanges and brokers. That said, eToro also charges 0.5% when making non-USD withdrawals. This is because US dollars will need to be exchanged back to the required currency. Additionally, non-USD withdrawals also come with a $5 fee. In addition to payments, customers also need to consider trading commissions when electing to buy Dogecoin with eToro. eToro charges a simple and transparent fee of 1% when buying and selling crypto. This is incorporated into the market spread, which is the difference between bid (buy) and ask (sell) prices. Here’s an example of how eToro Dogecoin trading fees work: The eToro portfolio will now show that the Dogecoin position is in the red by 1% or $5. This is because $500 was invested, but the real-time value stands at $495. While eToro trading fees are not the cheapest, it is also important to factor in deposits. After all, eToro charges nothing for USD payments and just 0.5% on other currencies.

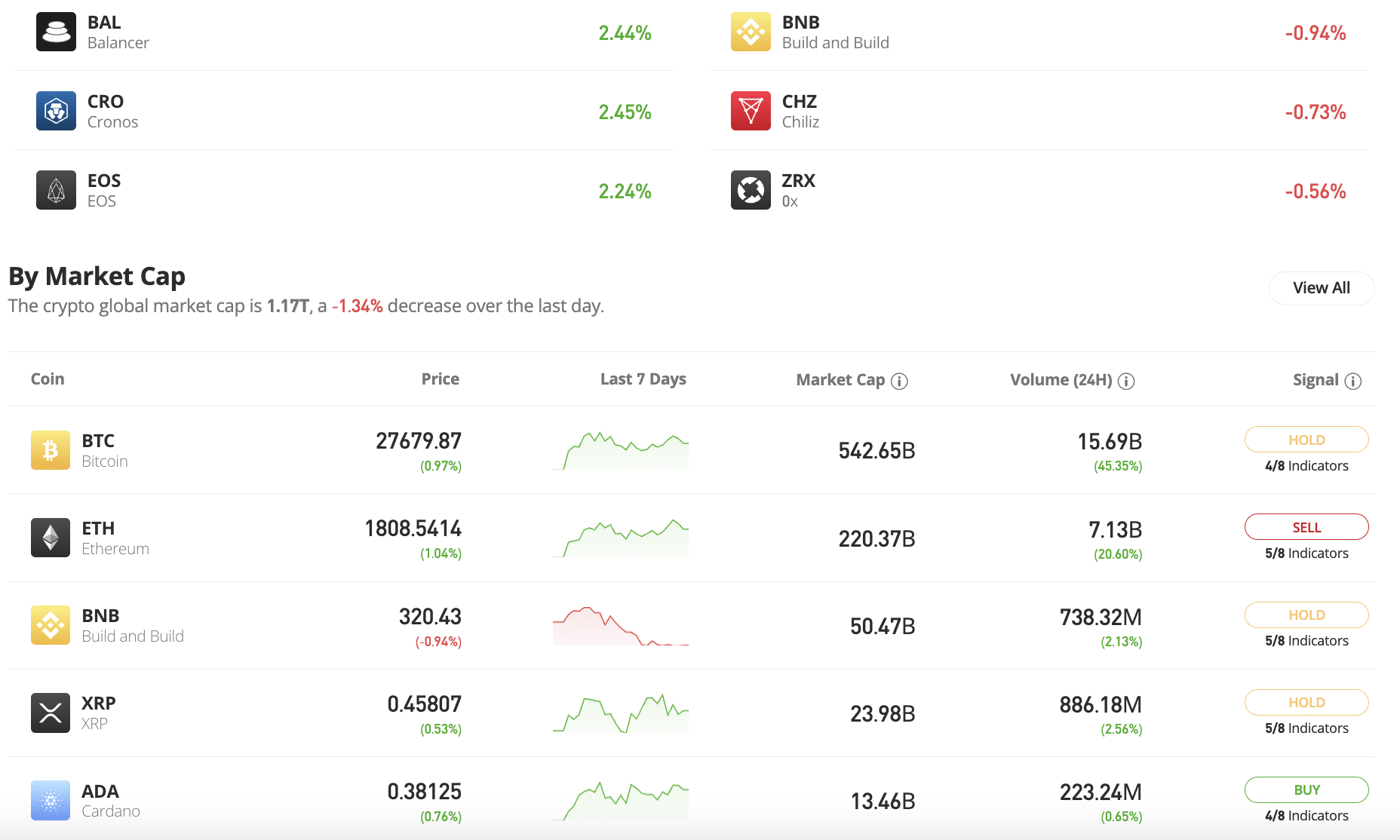

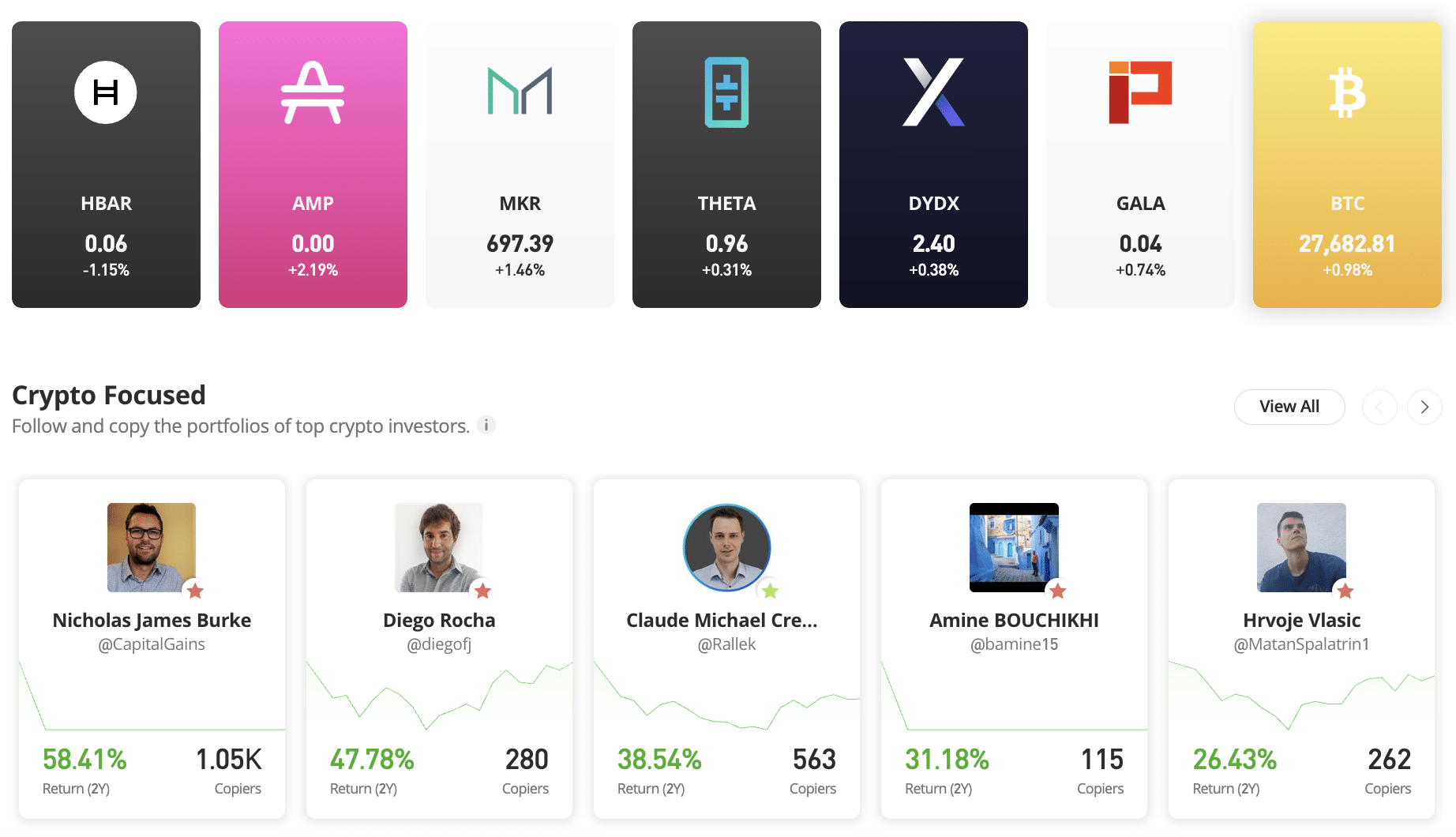

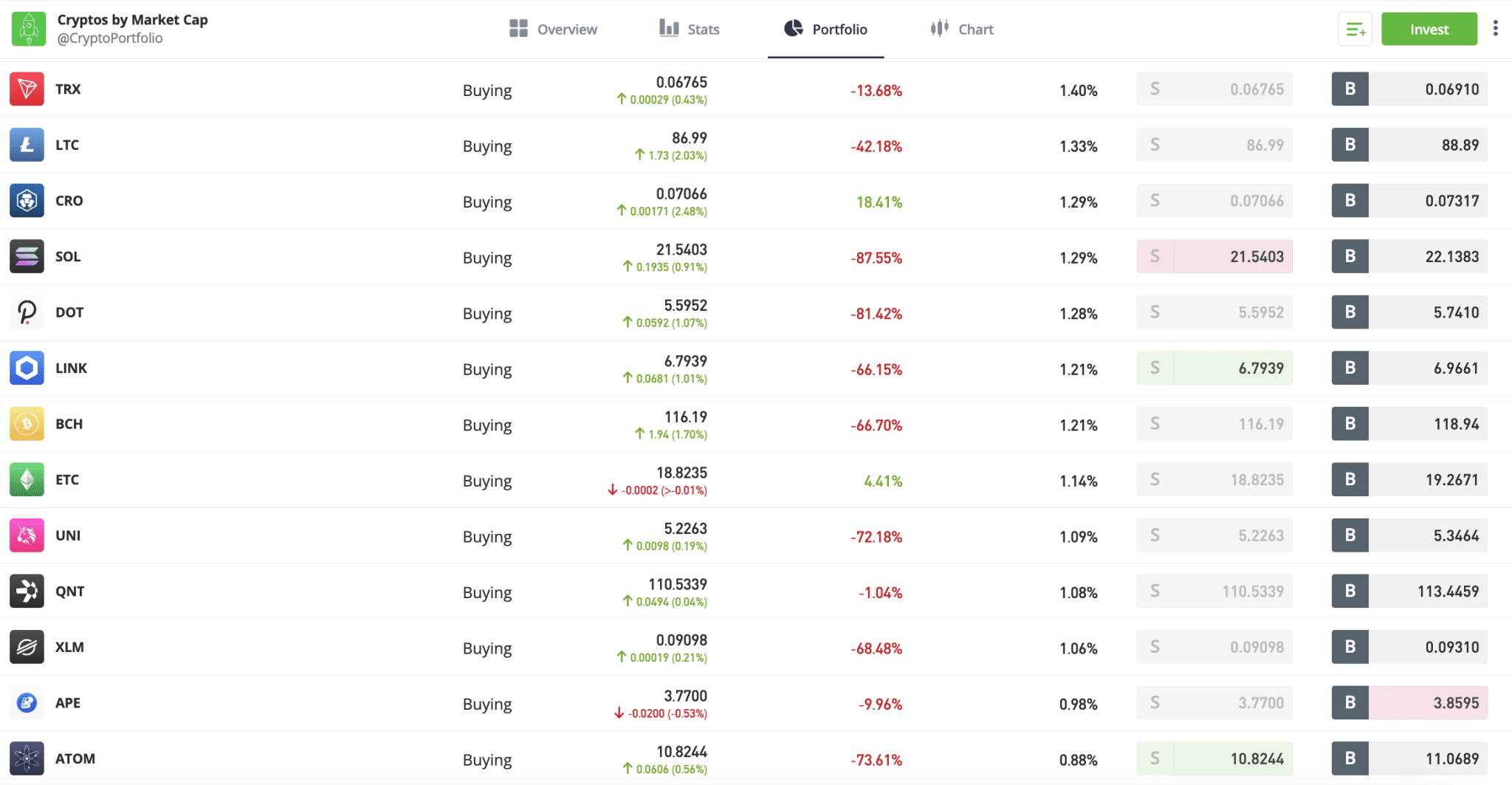

Crypto assets are a highly volatile unregulated investment product. No UK or EU investor protection. There are hundreds of crypto exchanges that list Dogecoin, so eToro operates in an oversaturated market. Below, we explore some of the reasons why eToro remains a top choice to buy Dogecoin in 2024. eToro is a regulated broker that was launched in 2007. It is used by over 30 million customers globally and is regulated in multiple jurisdictions. The latter includes the US (FINRA), the UK(FCA), Australia (ASIC), and Cyprus (CySEC). In light of this strong regulatory framework, eToro is considered a safe and secure place to buy Dogecoin. Not only is eToro popular for its commitment to regulation, but it is often the go-to broker for first-time crypto investors. For example, its user-friendly platform makes it simple to open an account, deposit funds, and buy Dogecoin. What’s more, the minimum deposit starts at just $10, and multiple convenient payment methods are accepted. For instance, it’s possible to buy Dogecoin with eToro via debit/credit cards, e-wallets, ACH, and bank wires. Unlike other crypto platforms accepting these payment methods, eToro does not charge exorbitant fees. As noted above, USD deposits are fee-free. Non-USD deposits are charged a small foreign exchange fee of just 0.5%. This is the case across all payment methods. In terms of trading fees, eToro charges a flat 1% commission on all cryptocurrencies, including Dogecoin. This is charged when buying and selling crypto. Lower commissions are available elsewhere, but this is often at the expense of high deposit fees or loose regulation. In terms of security, eToro offers custodial storage on Dogecoin investments. This means it safeguards the tokens on behalf of investors. This is achieved through institutional-grade security controls, in addition to cold storage and two-factor authentication. Those looking to diversify their crypto portfolio have several options at eToro. First, eToro supports over 90 cryptocurrencies, including everything from Bitcoin, Shiba Inu, and Ethereum to Litecoin, BNB, and XRP. The minimum trade size on all crypto assets is just $10. To streamline the diversification process, eToro also offers smart portfolios. These are bundles of cryptocurrencies hand-picked by eToro, and each has its own strategy. For example, the ‘Scalable’ smart portfolio focuses on 15 cryptocurrencies that can handle high transaction amounts. This includes Solana, Cardano, Polkadot, and EOS. The ‘DeFi’ smart portfolio focuses on cryptocurrencies involved in decentralized finance. Across 10 different crypto assets, this includes Aave, Yearn.finance, Uniswap, and Maker. There are 15 crypto-focused smart portfolios at eToro, and each is professionally managed. This means the portfolio is actively managed and rebalanced on behalf of investors. The minimum smart portfolio investment is $500. Alternatively, diversification can also be achieved through the eToro copy trading service. This is also a passive investment tool but instead of investing in portfolios, users ‘copy’ other traders. For instance, let’s say an eToro user copies an experienced crypto investor that buys Ethereum, Uniswap, and BNB. The same investments will be added to the user’s portfolio, at a proportionate amount. The minimum copy trading investment is $200 per trader. eToro is also a great place to diversify into other assets. It lists thousands of stocks and ETFs from over a dozen markets, including the US, UK, Hong Kong, and Saudi Arabia. All stocks and ETFs are commission-free. Pros Cons

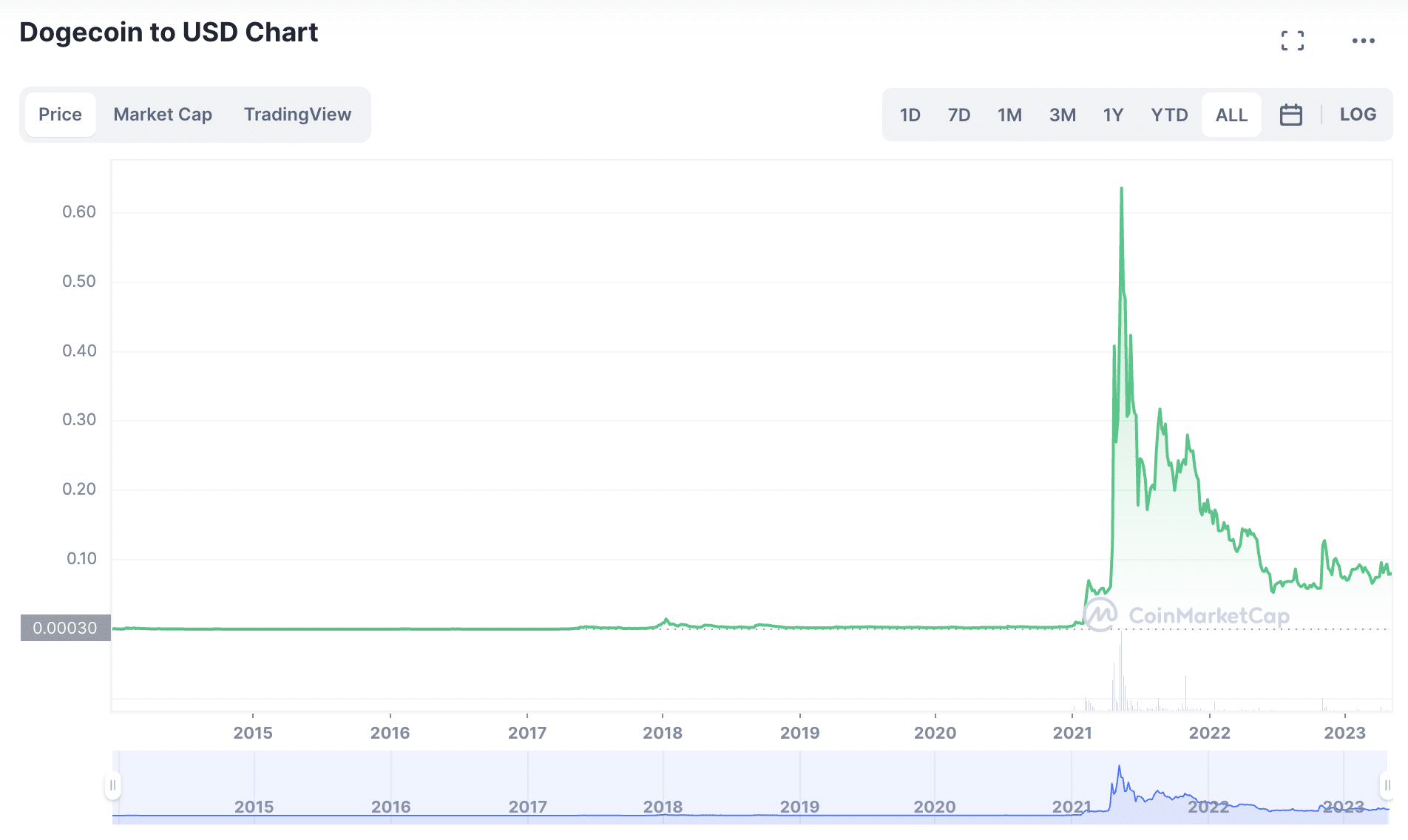

Crypto assets are a highly volatile unregulated investment product. No UK or EU investor protection. Dogecoin was created in 2013 as a joke and remained on the sidelines for many years. This Bitcoin alternative has since become a multi-billion dollar asset – providing significant gains during the previous bull market. While many view Dogecoin as a ‘meme coin’, it offers faster and cheaper payments than Bitcoin. The frenzy surrounding Dogecoin has been remarkable in recent years. This was amplified in 2021 when Tesla CEO Elon Musk made multiple tweets about the potential of Dogecoin. But investors should avoid buying this speculative digital asset without understanding the risks. In this section, we explain everything there is to know about buying Dogecoin as a beginner. Dogecoin is a cryptocurrency that was launched in 2013. It was initially created as a joke to highlight how speculative the crypto industry had become. Its founders opted for a Shiba Inu dog as the project’s logo. Other than enabling people to send and receive tokens, Dogecoin had no real use case. This is why Dogecoin is often described as the original ‘meme coin’. A year after its creation, Dogecoin secured its first use case – a tipping currency on the Reddit forum. Due to its ultra-low value, Redditors would send DOGE tokens to users as a way to appreciate posts they liked. During the next few years, Dogecoin remained on the sidelines, superseded by new and innovative projects like Ethereum and Cardano. However, things quickly changed in early 2021: While the value of Dogecoin has since witnessed a huge decline, it remains a top 10 cryptocurrency by market capitalization. Currently, Dogecoin has a value of $10 billion. At its peak in 2021, Dogecoin was valued at over $80 billion. In terms of the fundamentals, Dogecoin claims that its utility comes as a payment currency. Transactions are often confirmed in just one minute, and fees average a small fraction of a dollar. Moreover, Dogecoin transactions are decentralized. This means no single person or authority controls the network. As such, Dogecoin is suitable for those that want full control over their wealth. The primary focus of Dogecoin is to be considered as a payment currency. As noted above, it supports fast and cheap transactions, making it ideal for this purpose. However, like most cryptocurrencies, people typically buy Dogecoin as a speculative investment. In other words, Dogecoin investors hope to secure a sizable upside on their purchase. The key issue with this is that it’s all about timing. For instance, those that joined the Dogecoin frenzy in early 2021 would have witnessed unprecedented gains over the following few months. But those that bought close to its peak in May 2021 will now be looking at huge losses. Some analysts argue that current prices offer a great entry point for long-term investors. This is because Dogecoin is trading nearly 90% below its former all-time high. That said, a range of online stores now accept Dogecoin as payment. Tesla, for example, enables customers to purchase selected products with Dogecoin, including merchandise. Other notable merchants include Newegg, Cheap Air, Twitch, and the Dallas Mavericks. While Dogecoin does execute transactions faster and cheaper than Bitcoin, it is largely a vehicle for speculative investments. Dogecoin is particularly popular with investors that seek much higher returns than the stock market can offer. After all, Dogecoin generated gains of over 14,000% in the first five months of 2021 alone. Understanding the benefits and risks of Dogecoin is crucial before making an investment. Below, we explore the main factors to consider prior to buying Dogecoin. Make no mistake about it – Dogecoin has one of the largest and most loyal communities in the cryptocurrency space. For example, it is estimated that more than four million people currently hold Dogecoin. Moreover, the Dogecoin Reddit group has over 2.4 million subscribers. Having such a large community can play a major role in the future of Dogecoin. After all, the more awareness and exposure the cryptocurrency has, the more buying pressure it can create. This became evident in mid-2021 when Dogecoin surpassed a market capitalization of over $80 billion. While transaction speeds vary depending on network demand, Dogecoin offers speedy payment times. For instance, data over the prior 24 hours shows that the average Dogecoin transaction took just 1 minute and 3 seconds. In comparison, Bitcoin transactions average 10 minutes. This makes Dogecoin more suitable as a payment currency, at least in terms of speed. Additionally, Dogecoin is also considered suitable as a payment method for its low transaction fees. Over the prior 24 hours, Dogecoin transaction fees averaged just $0.08. Over the same period, Bitcoin fees averaged $7.45. Another benefit of Dogecoin’s fee system is that it does not take transaction amounts into account. For instance, whether $1, $100, or $1 million was sent over the past 24 hours, the average fee would have remained $0.08. This makes Dogecoin ideal for larger transactions, as users can avoid percentage-based fees. Dogecoin is a decentralized network, which may appeal to some investors. This means that no single person controls the network. Instead, transactions are verified by ‘miners’, who earn a percentage of transaction fees. Plus, by holding Dogecoin in a decentralized wallet, investors have full control over their funds. This means the funds cannot be frozen or seized, nor can transactions be blocked. While the features above will appeal to some investors, most people are interested in Dogecoin for its upside potential. Although new investors missed out on Dogecoin’s parabolic run in early 2021, its price has since declined. This enables investors to buy Dogecoin at an attractive entry price. For example, Dogecoin currently trades at under $0.8 per token. Compare this to its all-time high of $0.74, and that’s a decline of almost 90%. On the flip side, those buying Dogecoin at current prices will be well-prepared for the next crypto bull run. Depending on the investor’s goals, an initial long-term target could be a return to the $0.74 level. This would yield an upside of over 800% based on current prices. Another benefit of owning Dogecoin is that an increasing number of merchants accept it as payment. Crucially, BitPay – the leading crypto payment provider for merchants, supports Dogecoin. This means Dogecoin is accepted by over 250+ global brands. For example, AMC Theatres, Dish TV, Dallas Mavericks, Microsoft, Newegg, Twitch, TradingView, and many others. Some investors are attracted to Dogecoin because of its cheap token price. As noted above, Dogecoin is currently available at under $0.08, and it has never surpassed a dollar. In comparison, Bitcoin trades for tens of thousands of dollars. This means that casual investors will only likely own a tiny fraction of a BTC token. But by Dogecoin, small investments can yield a large number of DOGE. Beginners will be pleased to know that it’s possible to buy Dogecoin with just a few dollars. But do remember that minimums will vary depending on the chosen broker/exchange and payment method. For example, when electing to buy Dogecoin with eToro, the minimum requirement is just $10. But other platforms might have higher minimums, so it is wise to check before proceeding. Nonetheless, even with an investment of $10, this would yield over 140 DOGE tokens based on current prices. In comparison, investing $10 in Bitcoin would yield just 0.035 BTC. This makes Dogecoin more attractive to many. In summary, we have explained how to purchase Dogecoin on eToro in just five minutes. Overall, we found that eToro is a top choice when buying Dogecoin, considering its regulatory status and low fees. Beginners will also appreciate the broker’s simple layout, making it easy to buy and sell Dogecoin without prior experience. eToro also makes it seamless to diversify, with the broker supporting over 90 other cryptocurrencies.

Crypto assets are a highly volatile unregulated investment product. No UK or EU investor protection.How to Buy Dogecoin with eToro – Quick Guide 2024

How to Buy Dogecoin on eToro – Tutorial 2024

Step 1: Open an eToro Account

Step 2: Complete the KYC Process

Step 3: Deposit Funds

Step 4: Search for Dogecoin

Step 5: Set up an Order and Buy Dogecoin

eToro Dogecoin Wallet Options

How to Sell Dogecoin on eToro

How Much Does it Cost to Buy Dogecoin on eToro?

Payment Fees (USD)

Payment Fees (Non-USD Currencies)

Dogecoin Trading Fees

What Makes eToro a Good Place to Buy Dogecoin?

eToro Review

What to Know About Buying Dogecoin as a Beginner

What is Dogecoin?

What is Dogecoin Used for?

Why Invest in Dogecoin?

Huge Community

Fast Transactions

Low Transaction Fees

Decentralized

Potential for Appreciation

Increasing Number of Merchant Acceptance

Cheap Cryptocurrency to Buy

How Much Money do You Need to Buy Dogecoin?

Conclusion

FAQs

Can I buy Dogecoin on eToro?

Is eToro a good place to buy crypto?

How do I buy Dogecoin on eToro?