Ethereum Price Prediction – Where is the Biggest Altcoin Headed?

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.

Ethereum (ETH) is the second-largest cryptocurrency by market capitalization. It’s a widely popular protocol known for decentralized applications (dApps), smart contracts, and non-fungible tokens (NFTs).

Since its launch in 2015, Ethereum has experienced an incredible journey of ups and downs. It had several upgrades, and transitions and faced various challenges and opportunities. This article will explore factors that could potentially impact ETH’s future price.

What is Ethereum?

Ethereum is a decentralized and open-source blockchain network that allows you to create and run various applications without relying on intermediaries or facing censorship. The network utilizes its native cryptocurrency, ETH, to fuel operations and cover transaction fees known as gas fees.

Moreover, ETH serves multiple purposes, such as being a valuable digital asset for storing wealth, facilitating exchanges of value, or acting as collateral for lending and borrowing.

Ethereum is different from Bitcoin (BTC) in several ways. Its design is more flexible and programmable, allowing developers to create smart contracts. These self-executing agreements can encode various logic or rules.

Notably, smart contracts enable the creation of decentralized applications (dApps), which operate on the blockchain without a central authority or server. Diverse examples of dApps include decentralized exchanges (DEXs), decentralized finance (DeFi) protocols, gaming platforms, social media platforms, and NFT marketplaces.

Current Key Figures

| Market Price | $1,886 |

| Price Change 7 days | -2.86% |

| Market Capitalization | $ 224.41B |

| Circulating Supply | 120.19M |

| Trading Volume | $ 4.75B |

| All-Time High | $4891.7 |

| All-time low | $0.4209 |

Key Use Cases of Ethereum

Ethereum has played a significant role in expanding blockchain technology to the moon. It offers enhanced efficiency, faster transactions, and decentralized applications to industries worldwide. Let’s dive into the widespread and rapidly expanding use cases of Ethereum:

- Decentralized Finance (De-Fi).

- Decentralized Autonomous Organizations (DAOs).

- Smart Contracts.

- Non-Fungible Tokens (NFTs).

- Decentralized apps or Dapps.

In a nutshell, Ethereum offers utility and creates value across various sectors. Industries like entertainment, real estate, and even healthcare are developing applications and tools based on the blockchain solutions provided by Ethereum.

To understand the future direction of Ethereum and grasp its forecast, it’s crucial first to comprehend its unique model. Unlike other cryptocurrencies, Ethereum stands apart in many ways.

Understanding the Functioning of Ethereum

Ethereum’s switch to PoS: The Ethereum network initially operated using a consensus mechanism known as proof-of-work (PoW). However, in 2022, it made the transition to proof-of-stake (PoS), which is considered more secure and energy-efficient.

Moreover, PoS is highly effective in implementing scaling solutions compared to its previous model.

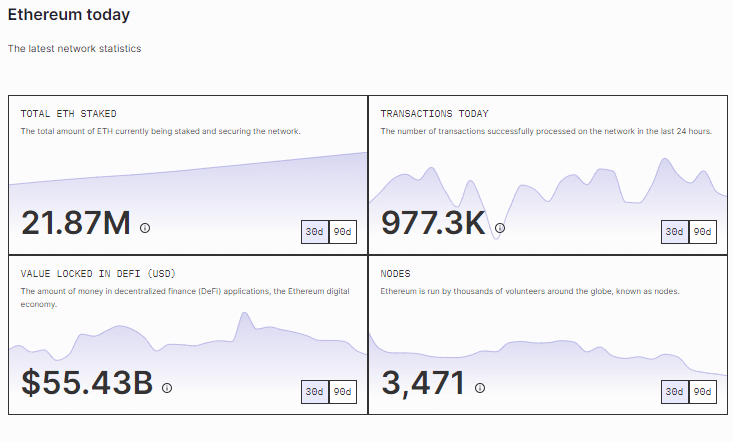

Validators and staking: In the PoS model, validators can stake their capital in the form of ETH and participate in the network. This staked ETH serves as collateral. Once activated, validators receive new blocks from other participants on the Ethereum network and are responsible for distributing them to other nodes within the network.

Block proposers and voting: Moreover, validator nodes play a crucial role in the blockchain network by collectively determining the authenticity and validity of newly generated blocks of transactions.

These nodes collaborate to ensure that only genuine blocks are permanently added to the main blockchain. Moreover, among these nodes, one particular node is selected as the “block proposer” for the current time slot.

PoS vs. PoW: A Proof of Stake (PoS) system holds an advantage over Proof of Work (PoW) as it eliminates the need for heavy computational power to solve puzzles. Instead, in a PoS setup, nodes validate new transactions and pledge their own value as collateral. These nodes diligently operate to safeguard their collateral from potential loss.

The merge and ETH 2.0: After years of dedicated work, the latest “merge” has been successfully implemented, marking Ethereum’s official shift to Proof-of-Stake. This significant change brings about a fundamental alteration in how the Ethereum network operates.

Instead of relying on traditional “miners,” validators have taken on responsible for approving, creating, and adding blocks to the Ethereum blockchain. However, this process is still in development as we await the arrival of Ethereum 2.0.

Ethereum’s potential and impact: Industries and experts worldwide are closely monitoring Ethereum 2.0 with great anticipation.

This groundbreaking development has the potential to revolutionize the Ethereum network by significantly reducing energy consumption compared to Bitcoin, which still relies on the PoW consensus mechanism. Moreover, ETH 2.0 will require less computational hardware, making it more accessible to a wide range of applications while minimizing scalability concerns.

What Drives Ethereum’s Price?

Supply and demand: The price of ETH is influenced by the balance between buyers and sellers. When there is high demand and low supply, the price tends to increase, and vice versa.

Network activity: The Ethereum network’s utility and value are reflected in its several transactions, smart contracts, decentralized applications, and other activities. An increase in network activity can potentially boost the demand for ETH and subsequently influence its price.

Gas fees: Gas fees represent the expenses associated with utilizing the Ethereum network and are paid in ETH. When gas fees increase, they can raise the cost of using ETH. Gas fees depend on network congestion and the complexity of transactions.

Mining difficulty: Mining difficulty measures the level of complexity in generating new blocks and earning ETH rewards. A higher mining difficulty can lead to a reduced supply of ETH and an increase in its price and discourage some miners from participating.

Innovation and development: The Ethereum network constantly evolves, introducing new features, upgrades, and improvements. These ongoing innovations and developments aim to enhance the performance, security, scalability, and usability of Ethereum, attracting more users and investors.

Regulation and adoption: The legal and regulatory environment surrounding cryptocurrencies holds the power to influence their popularity and acceptance. Law and adoption can vary across different countries and regions, giving rise to opportunities and challenges for Ethereum.

Competition and interoperability: Ethereum faces stiff competition from various blockchain platforms that offer comparable or unique services and solutions. Competition and interoperability can can significantly impact Ethereum’s market share, reputation, and overall value.

Sentiment and speculation: The perception and expectation of the general public regarding Ethereum have a significant impact on its price. Sentiments and beliefs are often influenced by various factors such as news, events, trends, rumors, and influencers, among others. Positive sentiment can boost prices, while an opposing view can lower costs.

Ethereum Current Price Status

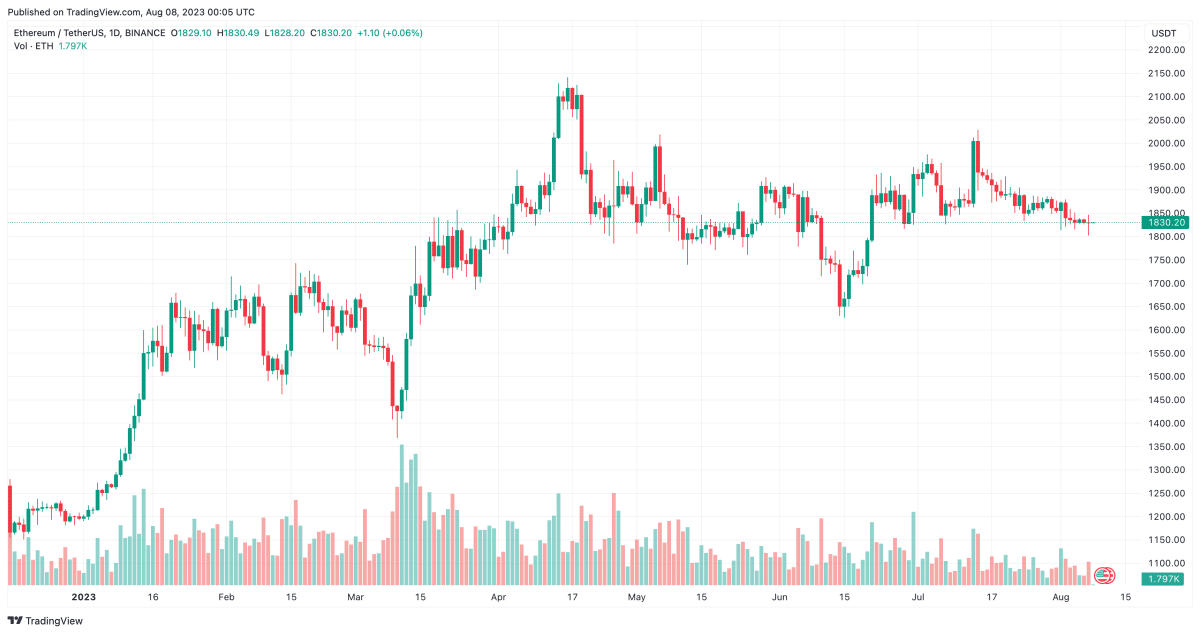

Since the start of 2023, the price of ETH has shown a clear upward trend. Back then, this leading altcoin was trading at the $1200 level. Over time, there has been gradual growth, resulting in the current price range of approximately $1900 for this token.

On a shorter timeframe, ETH has not met expectations. Its value dipped from $2000 in April to $1800, causing concern among investors. However, when considering the bigger picture, ETH exhibits technical strength and future potential.

ETH’s Price History

For a long time, Ethereum did not show any excitement. It was merely perceived as another cryptocurrency in the market. However, due to various compelling reasons, its value was inevitably destined to increase—and that’s precisely what occurred.

The migration from Bitcoin to Ethereum happened because Ethereum’s transactions are significantly faster. This attracted many people, as they found the first-ever cryptocurrency obsolete.

Additionally, the Ethereum blockchain offers a platform for creating decentralized applications or dApps.

The interest surge in Ethereum compelled people to seek out new blocks and validate transactions. Consequently, several miners shifted their hash rate allocation from BTC to ETH.

This strategic move resulted in the discovery of multiple new blocks, leading to an increase in mining difficulty and associated costs. Below are some historical highlights for Ethereum.

- 2015: ETH launched at $0.31 in the ICO campaign.

- 2016: ETH crossed the $10 mark in March.

- 2017: ETH reached its peak of $1,432 in January.

- 2018: ETH plummeted to $83 in December amid the crypto crash.

- 2019: ETH recovered slightly to $132 by the end of the year.

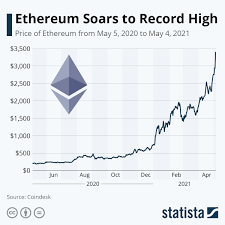

- 2020: ETH surged to $735 in December, driven by the DeFi boom.

- 2021: ETH hit a new all-time high of $4,362 in May.

- 2022: ETH dropped to $1,879 in July amid regulatory uncertainty.

- 2023: ETH is trading at $1,830 as of August 8.

ETH Technical Analysis

When the rally began on March 3, 2020, very few could have imagined that Ethereum would reach such high levels quickly. After enduring a continuous downtrend for years, Ethereum finally found support around $110. It then experienced a gradual but steady rise over four months before surging impulsively to $480.

Traders took profit, and the world braced itself for another period of consolidation that typically follows volatile price swings in the cryptocurrency market. To everyone’s surprise, Ethereum’s price remained stable from September until the first few days of November, when it once again skyrocketed.

On January 19, 2021, Ethereum achieved its highest value at $1,422. However faced strong resistance and underwent rigorous testing and scrutiny for several weeks. Despite the challenges, the price eventually broke through and gained momentum.

The entire cryptocurrency community closely observed this development with great anticipation and optimism. True to expectations, Ethereum exceeded all predictions by surpassing one resistance level after another, establishing a highly bullish market trend and reaching unprecedented heights.

On November 16, 2021, Ethereum hit its all-time highest price of $4,891.70, marking the end of a remarkable run. Since then, however, Ethereum’s value has steadily declined under the weight of bearish solid pressure. Despite occasional attempts at recovery, it has struggled to regain its former heights.

On July 5, 2023, the sentiment surrounding Ethereum’s price prediction appears to be relatively neutral. It is worth noting that Ethereum is currently trading above its 200-day simple moving average (SMA), which has consistently indicated a “BUY” signal since June 15, 2023.

In addition, it is worth noting that the current Ethereum price has surpassed the 50-day Simple Moving Average (SMA) since June 21, 2023. This technical indicator provides a “BUY” signal, indicating positive

Ethereum’s Short-term Price Prediction

| Date | Avg Price | Lowest Price | Highest Price |

| July 28, 2023 | $1889.99 | $1757.70 | $2022.29 |

| August 2, 2023 | $1948.88 | $1812.46 | $2085.31 |

| August 7, 2023 | $2011.79 | $1870.97 | $2152.62 |

| August 17, 2023 | $2126.39 | $1977.55 | $2275.24 |

| September 2023 | $2225.31 | $2069.54 | $2381.08 |

| October 2023 | $2269.16 | $2110.32 | $2428.01 |

| November 2023 | $2313.02 | $2151.11 | $2474.93 |

| December 2023 | $2356.88 | $2191.90 | $2521.86 |

Ethereum price prediction July 28, 2023: According to our analysis, Ethereum is projected to have a price range between $1757.70 and $2022.29 on July 28, 2023. The average price of ETH during that time is expected to be around $1889.

Ethereum price prediction August 2, 2023: According to our analysis, Ethereum’s price on August 2, 2023, is projected to range between $1812.46 and $2085.31. The average price of ETH during that time is estimated to be approximately $1948.88

Ethereum price prediction August 7, 2023: According to our analysis, the estimated price range for Ethereum on August 7, 2023, is expected to be between $1870.97 and $2152.62. The average price of ETH during this period is projected to be approximately $2011

Ethereum price prediction August 17, 2023: According to our analysis, Ethereum’s price on August 17, 2023, is projected to fall within the range of $1977.55 to $2275.24. The average price for ETH during this period is expected to be approximately $212

Ethereum price prediction September 2023: According to the analysis, Ethereum’s price for September 2023 is projected to range between $2069.54 and $2381.08. The average price of ETH during that period is estimated to be approximately $2225.31.

Ethereum price prediction October 2023: According to our analysis, the price range of Ethereum for October 2023 is projected to be between $2110.32 and $2428.01. Additionally, the average price of ETH during that period is estimated to be around $2269.

Ethereum price prediction November 2023: According to our analysis, the projected price range for Ethereum in November 2023 is estimated to be between $2151.11 and $2474.93. The average price during this period is expected to hover around $2313.02.

Ethereum price prediction December 2023: According to the analysis, Ethereum’s price in December 2023 is projected to fall within the range of $2191.90 to $2521.86. The average price of ETH during that period is expected to be approximately $2356.

Ethereum (ETH) Long-term Price Prediction for 2023, 2025, and 2030

The cryptocurrency market shows high volatility, making it challenging to provide accurate long-term forecasts. Nonetheless, numerous analysts have formulated their perspectives on popular cryptocurrencies like Ethereum. Below, we present some price predictions for Ethereum provided by experts.

TradingBeasts Ethereum Price Prediction

TradingBeasts’ forecasts for Ethereum are projecting a neutral-bullish outlook. According to TradingBeast’s analysis, Ethereum’s price is expected to remain relatively stable in the upcoming year. By the end of 2023, it is estimated that the token will see an increase

The price is expected to grow in 2024 and average $2,299.214 by the end of the year. TradingBeasts’ Ethereum price prediction for 2025 and beyond is optimistic as well. The resource anticipates the token’s price to reach $3,008.604 in 2025 and $3,632.503 in 2026.

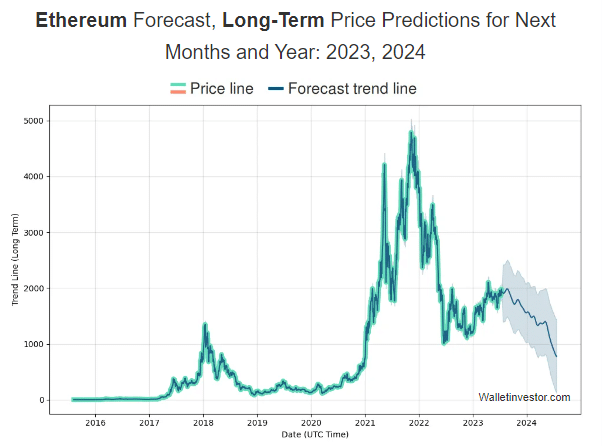

WalletInvestor Ethereum Price Prediction

According to WalletInvestor’s technical analysis, Ethereum is projected to perform poorly in both short- and long-term investments. Their prediction indicates that by the end of 2023, ETH could potentially decrease to $1,515.287.

In 2024, the price of this digital asset is predicted to continue its downward trend, reaching $265.446 by year-end. Even in 2028, WalletInvestor maintains a pessimistic outlook with a forecasted drop to $40.817 by mid-year.

Long Forecast Ethereum Price Prediction

Long Forecast’s predictions for ETH are overwhelmingly positive. They forecast that ETH will climb to $2,969 by the end of 2024, dipping below the $2,000 threshold before rebounding in late 2025 and surging to $2,333.

Their optimism continues as they envision Ethereum reaching a staggering $3,866 by 2027.

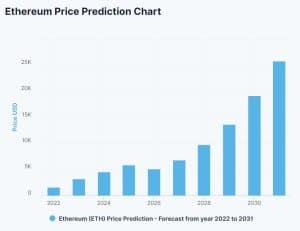

DigitalCoinPrice Ethereum Price Prediction

DigitalCoinPrice offers an optimistic long-term Ethereum price prediction spanning over the 10 years. According to their analysis, they anticipate the coin surpassing $4,081.58 by the end of 2023 and potentially reaching as high as $8,649.88 by 2026.

Furthermore, their forecast suggests an exponential rise in value, with projections indicating a staggering $36,687.70 by 2032.

Ethereum (ETH) Overall Future Price Predictions

Just as Bitcoin, the first-ever cryptocurrency, and Ethereum, the pioneer in creating smart contracts, hold significant positions in the cryptocurrency landscape. This strengthens their prospects for avoiding future crashes.

Presently, Ethereum enjoys widespread support from the cryptocurrency community, with many individuals maintaining their belief in ETH’s potential.

Today, the current system faces numerous challenges, impacting the volatility of Ethereum in the short term. The future performance is contingent upon the ability of the ETH team to address these vital issues.

Should they successfully resolve them, Ethereum will establish a strong position. Conversely, failure to do so may result in a significant decline in the cryptocurrency’s value.

How High Can Ethereum Go?

The Ethereum team’s exceptional talent is well-known within the cryptocurrency community, fostering high expectations for outstanding outcomes. Numerous voices on forums confidently assert that ETH will surpass all other platforms, emerging as the top choice for smart contracts.

Some experts believe that the position of Ethereum smart contracts is weakening. The developers are facing challenges in improving the system while adhering to the core principles of the ETH blockchain.

Competing projects like Solana are gaining momentum and threatening Ethereum’s dominance. Over time, with support from other promising ventures, Ethereum may face diminishing relevance.

The price of Ethereum does not solely depend on the development team. Numerous other factors, such as news, Bitcoin trends, altcoin activity, and more, also play a significant role. Given its interdependence, Ethereum is bound to face various obstacles.

How much potential does ETH have? It is highly likely to surpass the $14,000 mark, as predicted by WalletInvestor several months ago. Despite the current market conditions not being bullish, this asset still enjoys strong support.

If this situation stabilizes, there is a possibility of it reaching $4,000 once again and potentially even higher.

In the coming years, it is anticipated that ETH could potentially reach a peak value of $6,000. However, achieving further growth would likely require a significant market surge.

It’s important to note that such pumps often result in substantial corrections afterward. Therefore, it is advisable to adopt a realistic perspective and consider that ETH may not stabilize at $10,000 until at least 2025.

Will Ethereum Ever Outperform Bitcoin?

In the realm of cryptocurrencies, it is often said that anything is possible. This leads to the question: Can Ethereum ultimately surpass Bitcoin? Examining the year 2021 provides an exciting example, as ETH outperformed Bitcoin significantly.

With a remarkable growth of nearly 400%, Ethereum topped Bitcoin’s gain of only 66%.

However, experts have a belief that Ethereum’s unique blockchain and diverse use cases contribute to its stable future. It is even anticipated to outperform Bitcoin in the long run. Nevertheless, surpassing Bitcoin’s price seems improbable.

The potential for Ethereum to reach the same level as Bitcoin in terms of market capitalization is high due to its unlimited supply compared to Bitcoin.

Should You Consider Buying ETH?

The Ethereum mainnet merge has caught the attention of investors, leading to increased institutional funds and social volumes. The surge in interest could potentially favor the altcoin.

It’s essential for investors also to consider the macroeconomic impacts, as they may contribute to an extended bearish phase.

However, traders seeking to trade with the trend should wait for a bullish trend to emerge before considering buying the altcoin. In case ETH experiences movement in any direction, utilizing the RSI and CMF can be valuable tools for traders.

Bottom Line

After conducting thorough analysis and studying Ethereum’s performance since its inception, numerous analysts and market experts firmly believe in its long-term viability. This conviction stems from Ethereum’s strong foundational principles and immense potential.

The growth of Ethereum has been consistent, with ongoing advancements. As a result, many experts foresee a promising future for Ethereum in 2023 and beyond.

The increasing confidence in the technology and blockchain solutions suggests that Ethereum will soar to new heights. Long-term ETH holders can anticipate favorable outcomes without concerns of financial loss.