Best Accounting and Payroll Software | Top 6 Reviewed and Compared for 2023

With the best accounting and payroll software, businesses can manage their finances efficiently, accurately, and securely — without hiring an accountant. This software helps you keep track of expenses, revenue, and payroll in real time. However, finding one best suited to your business isn’t easy.

Here you’ll find a comprehensive review of the market’s 6 best accounting and payroll software solutions, including their features, pros, and cons, to help narrow down your options. Read on to find out how leading tools like Zoho Books, Oracle NetSuite, and QuickBooks can help you stay on top of your books.

The Best Accounting and Payroll Software | Top 6 Shortlist

Our research found that Zoho Books is the best overall accounting and payroll software because of its excellent customer support, intuitive interface, and automation that’ll make your life far easier. Here’s a quick breakdown of the market’s leading options:

- Zoho Books — By Far the Best Payroll and Accounting Software for Businesses of All Sizes | Try it Risk-Free Today for 14 Days.

- Oracle NetSuite — All-in-One Cloud-Based Accounting, Payroll, and HR Software | Sign Up Now and Get a Custom Quote.

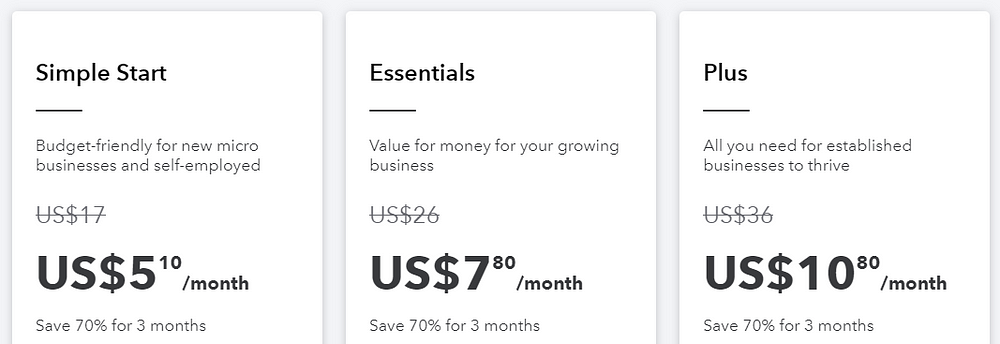

- QuickBooks — An Accountants Best Friend for Easy and Comprehensive Payroll Features | Get Up to 70% Off QuickBooks Now.

- Sage — Best Cloud-Based Accounting and Payroll Software for Mid-Market Companies.

- FreshBooks — Ideal Accounting Software Program for Small Businesses.

- Xero — Popular Free Payroll and Accounting Software with Robust Integrations.

The Top 6 Payroll and Accounting Software | Reviewed

Eager to learn more? Here we’ll explore the top 6 best accounting and payroll solutions in depth to help you find the one best suited for your needs. Let’s dive right in.

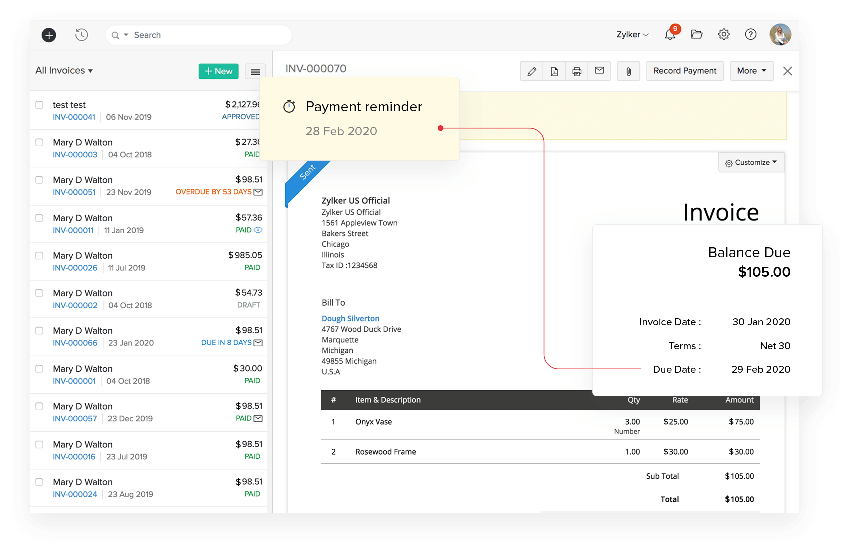

1. Zoho Books — Overall Top Pick for the Best Accounting and Payroll Software Program

Zoho Books isn’t just a popular accounting program but also a phenomenal solution for all-in-one payroll and invoicing. It’s easy to use, intuitive and offers a full range of features that’ll benefit any business.

| Pricing | No. Of Users | Mobile App | Trial Version |

| $10/month | 3 | Yes | Yes |

When it comes to workflow management and automation, Zoho takes our top spot.

It focuses heavily on automation and streamlining processes to save time and effort. For example, you can set up recurring invoices and automated payment reminders so your customers never miss a payment.

You can also integrate Zoho Books with Zoho Payroll, allowing you to manage payroll and accounting in one system. Easily set up statutory components by country, automate employee salary calculations, and generate payslips.

This comprehensive payroll system allows you to easily manage payroll, deductions, and reimbursements. You’ll never have to worry about manual errors such as miscalculations.

Plus, with Zoho Books, you can quickly generate reports and financial statements, including balance sheets and profit-and-loss accounts. This is great for understanding the overall performance of your business, allowing you to make better decisions in the future.

Pros

- Flexible pricing structure

- Robust automation and integrations

- Excellent payroll modules with Zoho Payroll

- Holds a phenomenal reputation

Cons

- Limited transactions per month

Pricing

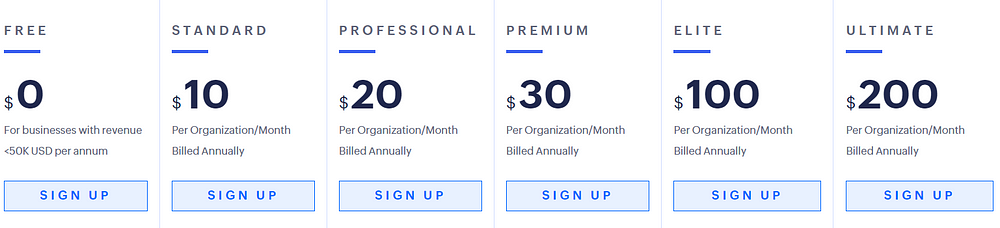

Zoho Books has flexible pricing plans for businesses of all sizes. Plus, as the best accounting software program, the free trial and free plan are a bonus. Here’s a breakdown of its pricing structure:

-

- Free — For businesses with revenue <50K USD per annum

- Standard — $10 — For 3 users

- Professional — $20 — For 5 users

- Premium — $30 — For 10 users

- Elite — $100 — For 10 users + Forecasting and Analytics

- Ultimate — $200 — For 15 users + Custom Modules

Overall, Zoho Books is hard to beat if you’re looking for an all-in-one accounting and payroll software solution. It’s the best small business accounting solution for those looking to streamline their processes and ensure they comply with regulations.

The only downside is that some of its plans come with limited monthly transactions — this will largely depend on your needs. Unsure? Try Zoho Books free now and experience why this tool repeatedly tops lists like this.

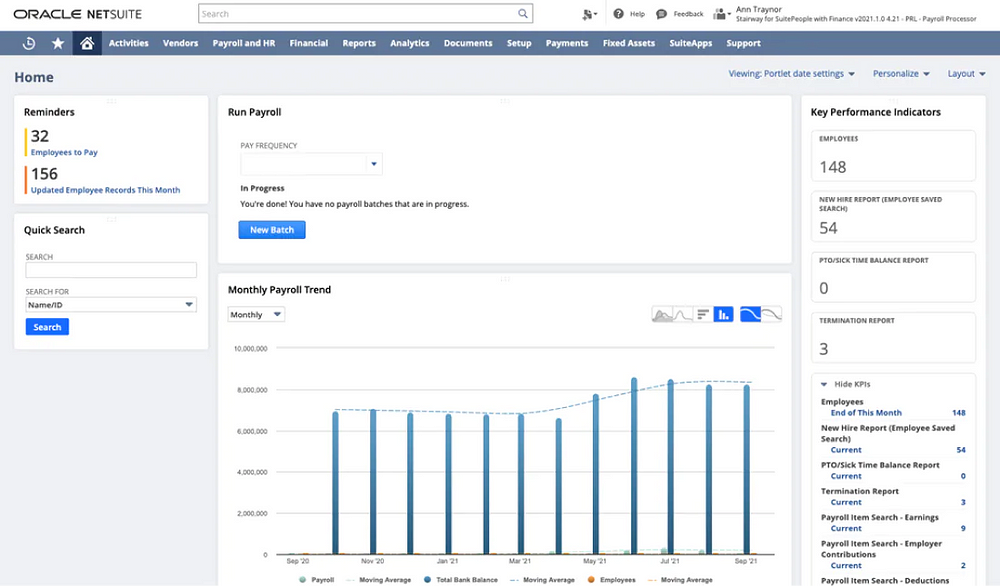

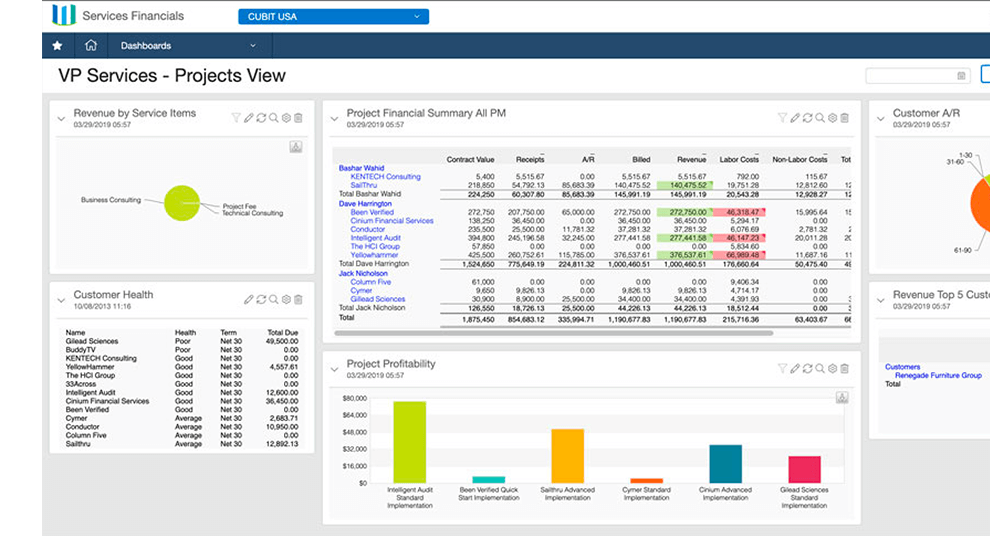

2. Oracle NetSuite — All-in-One Cloud-Based Accounting, Payroll, and HR Software

Oracle Netsuite is the leading cloud-based accounting, payroll, and HR software that provides medium to large businesses with an all-in-one solution for their financial needs.

| Pricing | No. Of Users | Mobile App | Trial Version |

| Not Published | Unspecified | Yes | Yes |

This powerful tool allows users to easily manage their finances from anywhere with its secure online platform. It offers a wide range of features, such as:

-

- Payroll processing

- Invoicing

- Budgeting

- Reporting

All this helps you streamline your operations and makes it easier to control costs. On the whole, The Oracle NetSuite accounting module is the backbone of this software.

It helps businesses save time by automating mundane tasks like invoice creation and makes managing accounts receivable straightforward. For example, users can easily view the amount owed to them, how much has been collected, and how many invoices are past due.

Besides this, the payroll module of Oracle NetSuite helps keep all employee data in one place, making it easier for businesses to manage their workforce.

This also includes features such as:

-

- Time tracking

- Attendance tracking

- Salary calculation

- Direct deposit payments

Imagine having this on the cloud — it’ll take away the burden of managing all these tasks manually.

On top of this, Oracle Netsuite complies with all major standards and integrates with other Oracle products, such as Business Intelligence, Human Capital Management, and Customer Relationship Management.

This software provides businesses with an all-in-one solution for their financial needs, so you no longer need to worry about different systems to manage different aspects of your business.

Pros

- Designed for medium to large businesses

- Excellent payroll modules

- One of the best cloud-based accounting tools

Cons

- Not ideal for small businesses

Pricing

Although Oracle NetSuite is a powerful financial tool, it comes with a hefty price tag. However, the pricing for this software depends on the features you require and the number of users in your organization.

It starts at $99 per month, but for accurate pricing, you’ll need to contact Oracle for a quote. It provides a secure, scalable, and reliable platform with best-in-class features — but it’s known for being better suited to larger businesses.

On the whole, this one-stop-shop software solution is worth considering if you’re looking to save time and money and further grow your business.

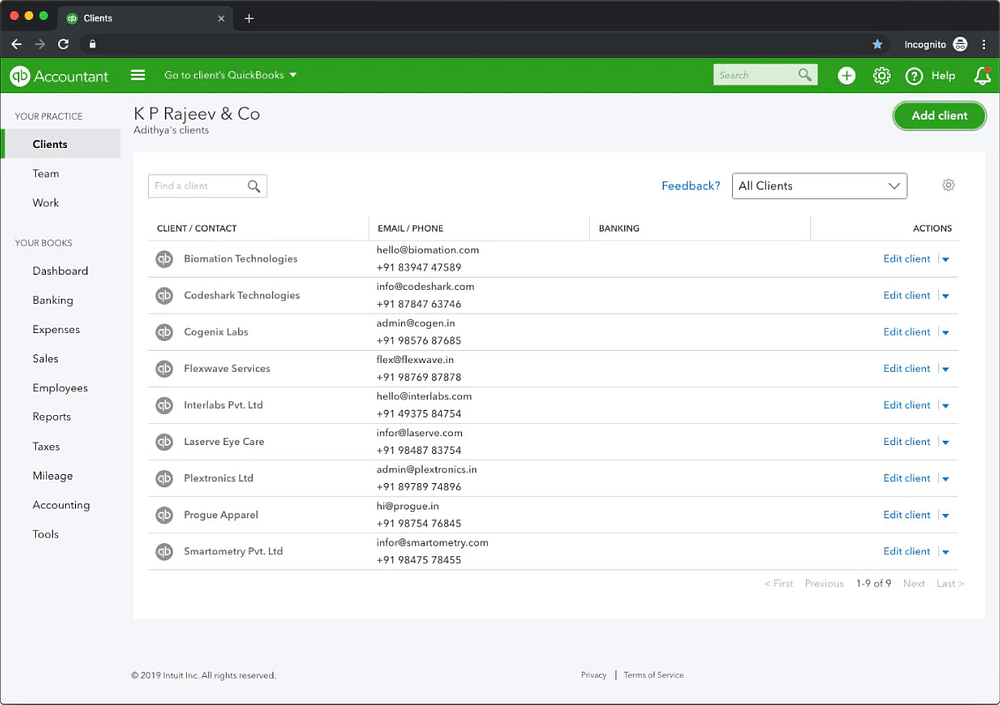

3. QuickBooks — Intuitive UI that Was Designed for Accountants

QuickBooks is an excellent choice for small businesses and accountants who need reliable accounting and payroll software. It’s not as advanced as other options on this list, but it’s user-friendly and has all the features necessary for basic accounting.

| Pricing | No. Of Users | Mobile App | Trial Version |

| $5.10/month | 1 | Yes | Yes |

QuickBooks also provides robust reporting capabilities that allow you to easily generate graphs and charts.

You can customize the reports according to your needs, which makes them extra useful for budgeting purposes. This helps track financial trends and ensure you make informed decisions about your business.

Besides this, QuickBooks also has an integrated payroll feature that allows you to pay employees on time and manage employee benefits, deductions, and taxes. It even includes a tax calculator to help accountants comply with all the necessary filing requirements.

Another significant feature of QuickBooks is its cloud-based platform, which makes the software accessible from any device with an internet connection.

This means you can access your account even if you’re away from the office; plus, all your data is safely stored in one place.

Pros

- Cheap but reliable

- Tax regulations-compliant

- Unlimited invoicing

Cons

- Not ideal for large-sized business

Pricing

For the basic version, QuickBooks includes unlimited invoices and reports and access to the payroll feature. You’ll need the Plus plan for premium features, such as advanced analytics and reporting tools.

QuickBooks is an excellent choice for small businesses and accountants who need reliable accounting and payroll software. It’s not the most comprehensive program on our list, but if you’re looking for an easy-to-use, solid solution, it’s a great option.

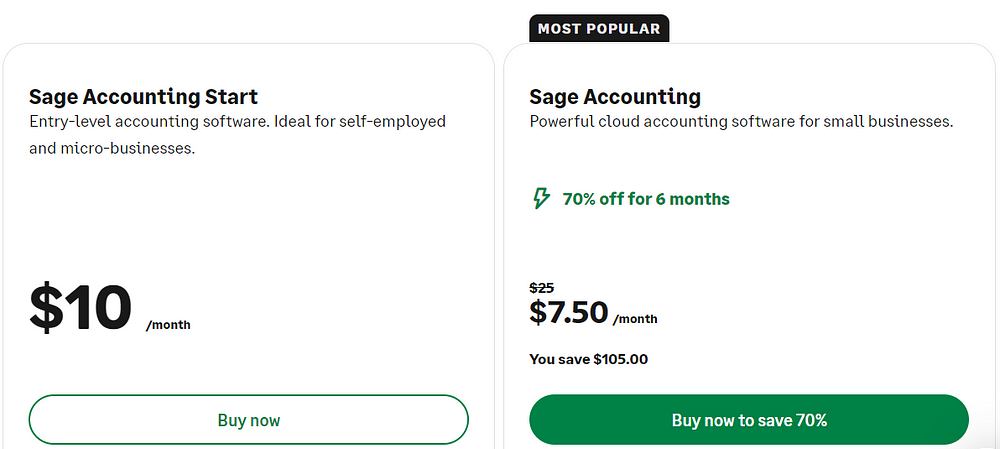

4. Sage — An Advanced Solution for MId-Market Companies

Sage One Cloud makes it simple for mid-market companies to manage their accounting and payroll needs. The top-notch payroll module will drastically reduce your paperwork, plus you can automate your invoicing — all with one tool.

| Pricing | No. Of Users | Mobile App | Trial Version |

| $7.50/month | 1 | Yes | Yes |

With Sage’s comprehensive accounting software, you can track your taxes without headaches. It’s HMRC-approved, which means UK users can easily use it to submit tax data online.

Plus, the payroll module of Sage One Cloud makes it easy to manage your payroll team. You can set up employee salaries, bonuses, deductions, and other payment types without hassle.

Besides this, you can easily track your employees’ time with its integrated time-tracking feature, which ensures accurate monthly paychecks.

Having everything in one central system is very important for mid-market companies as it eliminates the need for multiple software programs and makes it easy to manage your workforce.

Furthermore, Sage One Cloud features an advanced reporting system designed to give you insight into your business finances. It can generate detailed reports on cash flow and P&L statements, and you can also track expenses and income — this helps to identify areas of improvement and make better data-based decisions for your business.

Pros

- HRMC-approved

- Budget-friendly

- Tax-tracking system

Cons

- Steep learning curve

Pricing

When it comes to pricing, there aren’t a lot of options. The software is currently offered in two plans. The starter plan is best for businesses with up to 9 employees, while the other is suitable for businesses with 10 or more employees.

Although Sage’s interface is a bit clunky and dated, overall, it offers a boatload of features designed to save time and prevent errors.

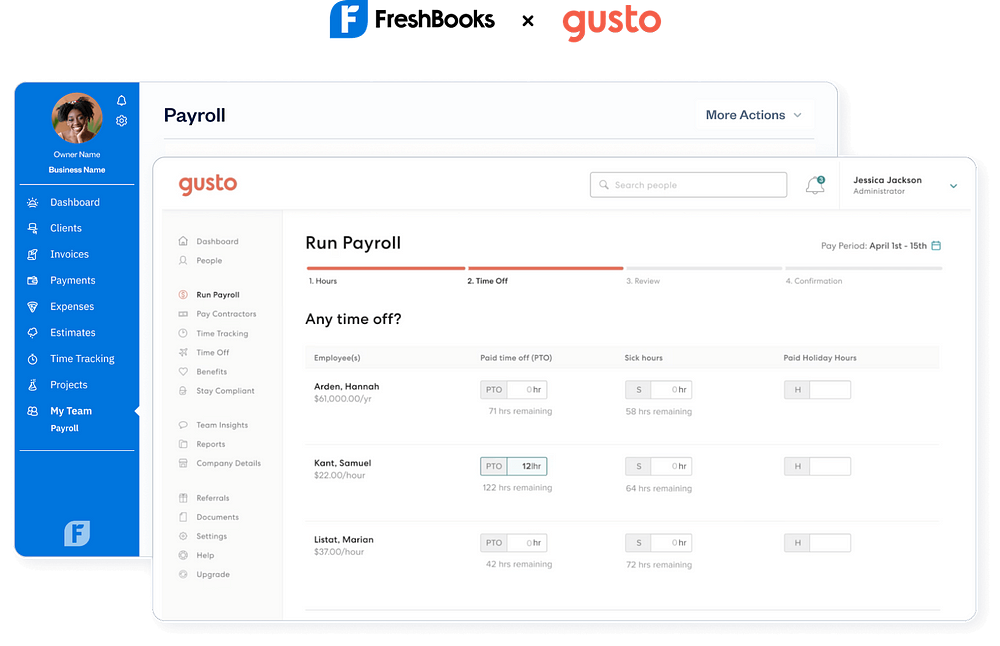

5. FreshBooks — Budget-Friendly Solution for Small Businesses

FreshBooks is perfect for budget-conscious small businesses that need easy-to-use accounting, employee management, payroll, and time-tracking software.

| Pricing | No. Of Users | Mobile App | Trial Version |

| $6/month | 5 | Yes | Yes |

Accounting software is a must-have software for small businesses, and if your budget is tight, FreshBooks is a great option. For one, you’ll get access to automatic tax payments and filings with FreshBooks.

This feature automatically pulls in your data and calculates the taxes for you. For example, you can set up payroll deductions and pay taxes quarterly or annually.

FreshBooks also integrates with various third-party apps to make your work easier, such as Stripe for payment processing and Gusto for payroll processing — imagine not having to worry about manually filing and paying taxes ever again.

You can also use FreshBooks to invoice your customers and accept payments quickly. Create custom invoices easily and ensure that all your customers are on the same page.

You can brand your invoices with your logo and track who’s paid and who hasn’t. On the whole, FreshBooks makes it easy if your small business to create and manage customized invoices.

Besides this, FreshBooks’ payroll system also takes care of your onboarding process and ensures that your employees’ data is up to date. You can also set up:

-

- Employee profiles

- Track hours worked

- Monitor paid time off

- Manage benefits

And much more. Overall, it’s a phenomenal solution to manage your employees and payroll with no hassle.

Pros

- Custom invoices

- Automated tax filing

- Basic time tracker

Cons

- Basic payroll software

Pricing

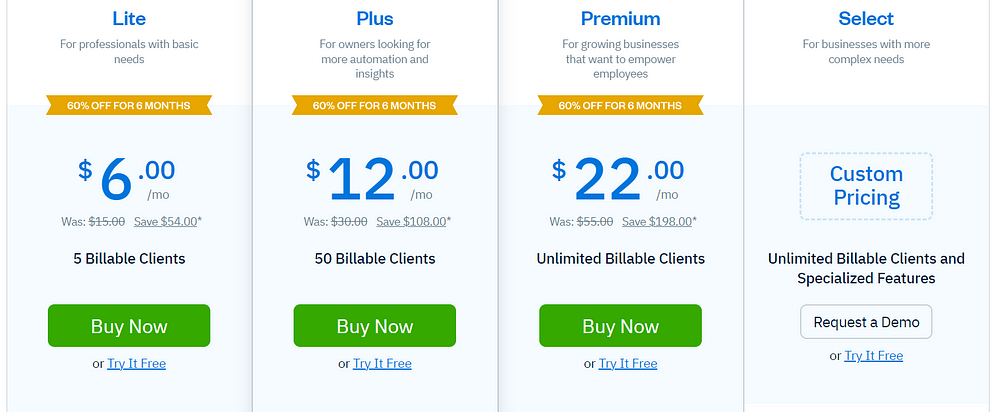

There are 4 pricing options with FreshBooks: Lite, Plus, Premium, and a custom plan. The Lite plan is only $6, but the Plus and Premium plans are $12 and $22 per month, respectively. All 3 plans come with unlimited invoices, time tracking, expense tracking, estimates, and payments.

The only downside with FreshBooks is that the payroll system isn’t as comprehensive as those of dedicated HR systems, but it’ll do the job if you don’t need advanced features.

FreshBooks is an excellent option for an affordable payroll and financial management solution. It has everything you need, from invoicing to payroll processing, and the tool integrates with various third-party apps.

Plus, it has its own time-tracking tool, but if you need a more robust time-tracking provider, check out our list of the best employee time-tracking software here.

6. Xero — Accounting Solution that Integrates Easily With Your System

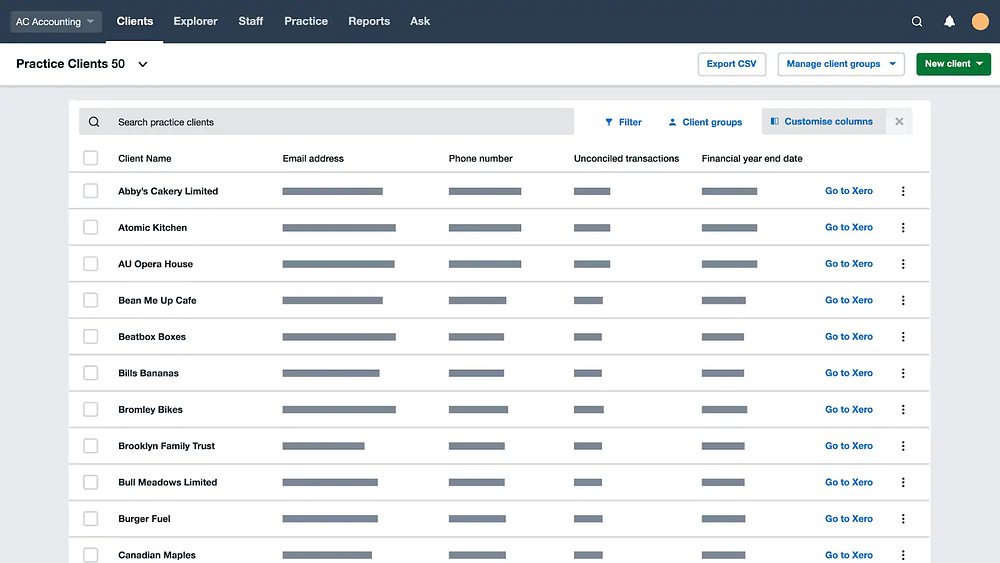

Xero is an accounting solution that provides small businesses with comprehensive tools to manage their finances. It integrates easily with existing business systems, allowing for quick and easy data entry.

| Pricing | No. Of Users | Mobile App | Trial Version |

| $13/month | Unlimited | Yes | Yes |

One of Xero’s biggest advantages over other accounting solutions is its intuitive user interface. This makes it simple for users to start using the software quickly without needing extensive training or technical know-how.

Xero also offers a range of features designed to help manage finances. For example, the application provides invoicing capabilities, bank reconciliation tools, credit card management options, and more.

You can even set up multiple accounts for different business purposes and track expenses across them all. This allows you to keep better tabs on your business finances, helping you make informed decisions about how to spend your funds efficiently.

Finally, Xero integrates easily with other popular software solutions such as QuickBooks Online and Microsoft Dynamics GP — meaning that you can switch between applications if needed.

On the whole, this makes it an ideal solution for businesses that need to manage multiple accounting systems at once.

Pros

- Can track inventory

- Cloud-based and secure

- Robust integrations with third-party solutions

Cons

- Expensive for small businesses

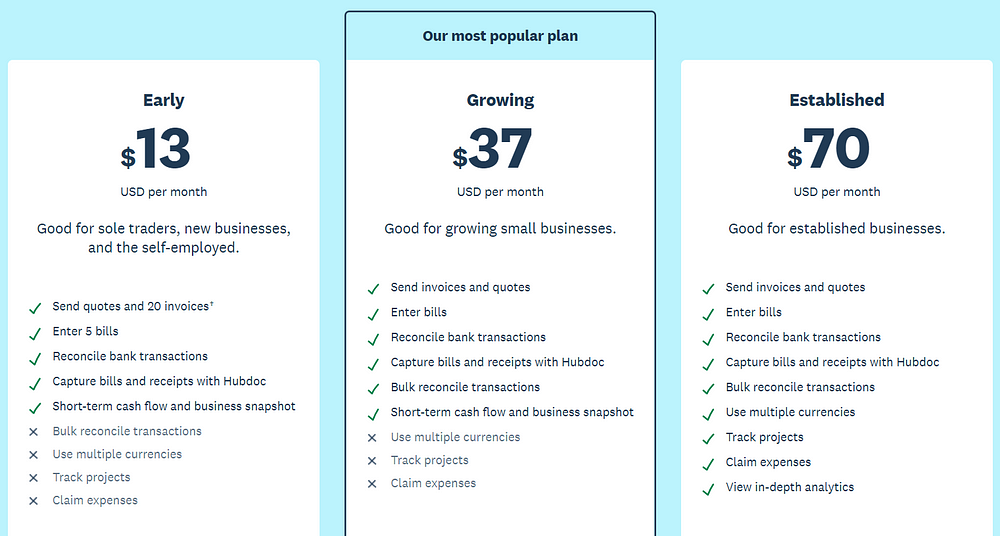

Pricing

Despite not being the cheapest software on our list, Xero offers a free 30-day trial for all users, along with a range of different pricing plans to suit businesses of any size.

The fundamental difference between these plans is the types of invoices you can send and the level of forecasting and analytics.

Although not as cheap as our other top picks, Xero is still a superb choice for business owners who want an easy-to-use accounting solution that integrates seamlessly with their existing systems.

Business Accounting and Payroll Solutions | Top 6 Compared

These six accounting and payroll solutions offer essential business features, such as invoicing, time tracking, expense management, reporting capabilities, tax filing, and more. Check out our side-by-side comparison table below:

| Software | Pricing | No. Of Users | Mobile App | Trial Version |

| Zoho | $10/month | 3 | Yes | Yes |

| Oracle Netsuite | Not Published | Unspecified | Yes | Yes |

| QuickBooks | $5.10/month | 1 | Yes | Yes |

| Sage Accounting | $7.50/month | 1 | Yes | Yes |

| FreshBooks | $6/month | 5 | Yes | Yes |

| Xero | $13/month | Unlimited | Yes | Yes |

Why You Need Accounting and Payroll Software for Your Business

It’s simple: accounting and payroll software is essential for businesses of all sizes because it makes managing finances and employee payroll much more manageable.

If you’re not utilizing accounting and payroll software, you’re missing out on several important benefits for your business. Here’s why:

- Automated Tax Calculations — Accounting and payroll software provide automated tax calculations, making it easier to complete your tax paperwork each year. This can save your accountant and bookkeeper a lot of time and it’ll help you get tax breaks.

- Improved Accuracy — Human errors can be costly when managing finances and employee paychecks. Accounting and payroll software eliminates these mistakes with accurate calculations that factor in deductions like taxes and other withholdings.

- Streamlined Reporting — This makes tracking finances and employee payroll easy. It’s also easier to generate reports quickly for filing taxes or creating financial statements.

- Time-Saving — With automated calculations, reporting, and filing of taxes and other documents, you can save a lot of time that would otherwise be spent manually completing these tasks. This time can be used in other crucial areas of the business.

- Cost Savings — Accounting and payroll software are often more cost-effective than hiring a full-time accountant or bookkeeper to manage your finances and employee paychecks each month, especially if you’re running a small business.

- Security — Payroll and accounting software helps secure your financial data by utilizing the latest encryption technology (similar to the best VPN services) to protect it from unauthorized access.

How We Chose the Best Payroll and Accounting Software for 2023

We reviewed the markets leading payroll and accounting software options to find the cream of the crop for large and small business owners alike. We narrowed down our search by taking into account the following:

Features

We looked for comprehensive software that offers robust features, including:

-

- Payroll processing

- Tax filing

- Accounts payable/receivable management

- General ledger tracking

- Inventory control

- Financial reporting capabilities

All the tools we’ve reviewed offer a variety of features for businesses of all sizes.

Ease of Use

The best software should be user-friendly with an intuitive interface so large and small business owners can easily manage their finances without needing to learn complicated processes or hire a professional accountant.

All 6 solutions reviewed here have phenomenal user reviews regarding ease of use and customer service — so we’re confident that you’ll have no issue with one of these.

Price

We considered several factors when determining the cost of a product, such as the number of users included in each plan and whether the company offers any special discounts or free trials.

On top of this, we considered the feature-to-value aspect to ensure that even if the pricing was a bit higher, you were guaranteed incredible value for money in terms of features provided for the price.

Customer Support

We considered the types of customer support offered by each software (e.g., phone, email, live chat) and the availability and response times of those services.

Our top 6 picks offer phenomenal support to ensure you’re never left struggling to get help.

Security

We ensured that each product had sufficient security measures to protect your financial data from unauthorized access or hacking attempts.

All these accounting and payroll solutions come with solid security measures in place, plus they all boast incredible reputations, with millions of businesses using them around the globe.

Accounting and Payroll Software FAQs

What software do most accountants use for payroll?

What’s the best payroll and accounting software?

What is a payroll accounting system?

Can Excel be used for payroll?

Can I get accounting software for free?

Is payroll bookkeeping or accounting?

Conclusion | What’s the Best Accounting and Payroll Software in 2023?

From small businesses to large corporations, having the right accounting and payroll software can be essential to the success of any organization. Accounting software helps businesses track income and expenses, while payroll software automates paying employees.

To ensure you’re making an informed decision when selecting a solution for your business, we’ve rounded up and reviewed these top 6 best accounting and payroll software solutions:

- Zoho Books — By Far the Best Payroll and Accounting Software for Businesses of All Sizes | Try it Risk-Free Today for 14 Days.

- Oracle NetSuite — All-in-One Cloud-Based Accounting, Payroll, and HR Software | Sign Up Now and Get a Custom Quote.

- QuickBooks — An Accountants Best Friend for Easy and Comprehensive Payroll Features | Get Up to 70% Off QuickBooks Now.

- Sage — Best Cloud-Based Accounting and Payroll Software for Mid-Market Companies.

- FreshBooks — Ideal Accounting Software Program for Small Businesses.

- Xero — Popular Free Payroll and Accounting Software with Robust Integrations.

We’re confident that Zoho Books is the best accounting and payroll software in 2023. It’s an integrated solution that helps businesses manage their finances, automate their workflow, and comply with tax regulations.

Additionally, Zoho Books integrates with various apps and services, which makes it easy to connect your business processes for a smoother experience. Plus, there’s a free plan.

Zoho Books is a perfect choice if you’re looking for a comprehensive yet affordable solution to handle your business’s accounting and payroll needs. Try it for 14 days for free or opt for the free plan and see the difference it’ll make in your business.